As proposed by the Superintendence of Popular and Solidarity Economy in the recent resolution SEPS-IGT-IGS-IGJ-INFMR-INR-INGINT-2022-003, where the considerations that the State has to promote the sustainable development of Savings and Credit Cooperatives are included, it is mandatory for all microfinance institutions in Ecuador to establish a Social and Environmental Risk Management System (SARAS).

Social and Environmental Risk Management System (SARAS) is the set of policies, procedures, tools and internal capabilities to determine and manage a financial institution’s exposure to environmental and social risks of its clients. This system reduces the probability and occurrence of legal, reputational, liability and climate change risks, as well as to strengthen the institution’s role in the community.

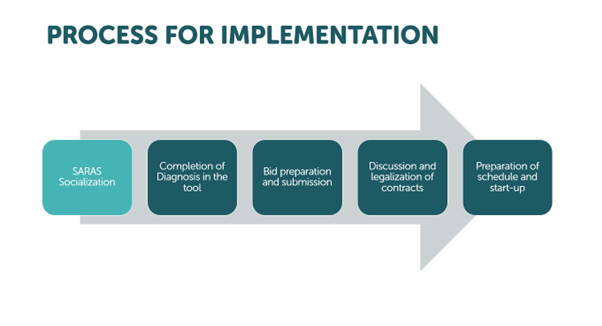

At YAPU Solutions we developed a digital tool that integrates the information guidelines requested by the Superintendence easily into institutional processes and in this way we offer a flexible solution to comply with the new regulations.

We invite you to join a free virtual event on October 18, at 10:00 a.m. (Ecuador) in which we explain details on the recent resolution and demonstrate our tool.

Please register here: https://us02web.zoom.us/webinar/register/WN_IXpzpyKoSIeW-AyIWpY-yQ

YAPU’s tool is based on: the experience and good practices in microfinance for years working in this sector, the legal regulations of the SEPS and based on international standards. The customized design of our YAPU tool for each institution facilitates access, enables compliance with regulations, reduces risk exposure and creates new business opportunities.

Watch the previous webinar explaining the YAPU SARAS tool: https://www.youtube.com/watch?v=7BPAI-bLzDQ

Share this Post